When creating a budget to buy or sell a home, there are extra fees that need to be factored into your financial plan such as closing costs, lender fees, and more. Another one of these added expenses to consider is real estate transfer tax. To put it simply, a real estate transfer tax is exactly what it sounds like: a tax on any change of ownership in real estate. If you’re unfamiliar with this tax and what exactly it entails, look no further. Our guide has everything you need to know about real estate transfer tax.

Real Estate Transfer Tax Defined

To break the term down further, real estate transfer taxes, (also referred to as a deed transfer tax, stamp tax, or conveyance tax) is a one-time fee paid to the city, county, or state when ownership transfers from the sellers to the new owner of the property. Essentially, this means the tax is applied when the buyers officially obtain the deed to their new home. Transfer taxes are based on the selling price or market value of the property being purchased. The specifics of tax rates vary by state, county, or town.

Who Pays the Real Estate Transfer Tax?

In most cases, the sellers are obligated to pay the transfer taxes, but this rule can vary state by state. For example, in the state of Pennsylvania, the expense is split evenly between both the buyers and sellers. There are even several states without any deed transfer taxes at all, including Alaska, Idaho, Indiana, Louisiana, Kansas, Mississippi, Missouri, Montana, New Mexico, North Dakota, Oregon, Texas, Utah, and Wyoming. No matter what state you live in, the buyers and sellers may have the opportunity to negotiate who is responsible for paying the tax.

It’s crucial that you have a clear understanding of your state’s regulations and requirements for the real estate transfer tax to prevent an extra expense from surprising you at the closing table. Talk with your local expert REALTOR® for more guidance on navigating this, and other additional expenses during your home buying or selling journey.

Are Transfer Taxes Deductible?

Transfer taxes are generally not deductible on a federal basis, but it is always a good idea to consult your tax professional or accountant to get a full picture of the tax implications. However, some states allow this tax to reduce your overall rate. As an example, California stamp taxes paid to your county can be used as a credit against your state tax liability. This means that the amount you pay in transfer taxes can help reduce your overall tax rate. You can consult with a tax professional to learn more about your specific situation.

Real Estate Transfer Tax in Massachusetts

In Massachusetts, the average cost of the transfer tax is $4.56 per $1000 of the sales price. As an example, if you’re selling your home for $650,000, the transfer taxes would total out to be $2,964. This amount may differ depending on your specific mortgage program, so be sure to clarify this with a professional mortgage lender. However, there are a few counties on Cape Cod that have a different rate like Barnstable County which charges $6.12 per $1000. In a Massachusetts real estate transaction, the sellers are responsible for paying the transfer tax to the Massachusetts Department of Revenue.

Real Estate Transfer Tax in New Hampshire

The paying of conveyance taxes is handled much differently in New Hampshire, as the expense is usually split between the buyers and sellers, although it’s always up for negotiation. Typically, the transfer tax is 1.5% of the property’s purchase price or its market value. If one party is covering this expense, the cost is $15 per $1000. On the other hand, if it is being split both the buyers and sellers pay $7.50 per $1000. The fee is paid to the registry of deeds when the deed is officially on record.

Real Estate Transfer Tax in Connecticut

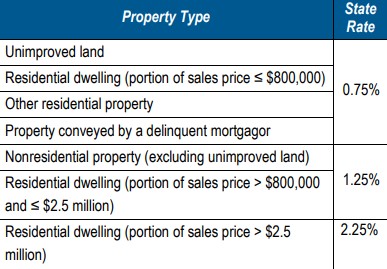

Real estate transfer taxes in Connecticut are a bit more complicated than in Massachusetts and New Hampshire. According to the Connecticut Office of Legislative Research, the conveyance tax has two parts: state tax and municipal tax. The state tax is based on the property type, as shown in the table below.

The municipal tax is an additional tax that is applied depending on the town or city the property is located in. This can change from a minimum of 0.25% to a maximum of 0.5% of the property’s purchase price. The towns in which the municipal tax is imposed are Bloomfield, Bridgeport, Bristol, East Hartford, Groton, Hamden, Hartford, Meriden, Middletown, New Britain, New Haven, New London, Norwalk, Norwich, Southington, Stamford, Thomaston, Waterbury, and Windham.

Like in Massachusetts, the sellers are obligated to pay the transfer tax.

Real Estate Transfer Tax in Florida

The Florida transfer tax is $.70 per $100 of the property’s purchase price throughout the entire state, except in Miami-Dade County, where it is $.60. As an example, a property in Fort Lauderdale purchased for $200,000 will have a transfer tax of $1,400. On the other hand, a $200,000 property purchased in Coral Gables, a town in Miami-Dade County, will have a transfer tax of $1,200 since the tax is only $.60 per $100 in this county. Like both Massachusetts and Connecticut, the sellers pay the real estate transfer tax.

In conclusion, understanding the implications of real estate transfer tax is crucial when budgeting to buy or sell a home. Having a clear picture of the cost for your specific state, county, or town allows you to be prepared for the closing table and the official transfer of the deed. While in most cases, the seller is obligated to pay this tax, this is sometimes negotiable. To ensure a smooth transaction and avoid any surprises, be sure to consult with your local expert REALTOR®.