MARCH 2023

massachusetts housing report

March Highlights

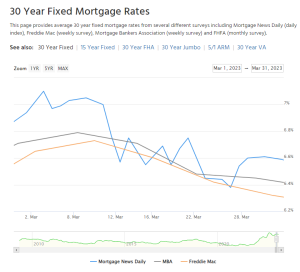

- Mortgage rates continue to keep consumers and

experts on their toes. In March, mortgage interest rates started at around 7%, but came down as the month went on. Economic factors such as inflation as well as monetary policy will continue to dictate the mortgage rate landscape as spring rolls on. Specifically, the ongoing bank crisis happening with major banks such as Silicon Valley Bank has caused a shock in the stock market and stirred financial fear and uncertainty among consumers, so buyers and sellers alike pulled back from the market even further as a result of these events.

experts on their toes. In March, mortgage interest rates started at around 7%, but came down as the month went on. Economic factors such as inflation as well as monetary policy will continue to dictate the mortgage rate landscape as spring rolls on. Specifically, the ongoing bank crisis happening with major banks such as Silicon Valley Bank has caused a shock in the stock market and stirred financial fear and uncertainty among consumers, so buyers and sellers alike pulled back from the market even further as a result of these events. - Many buyers took advantage of rates when they dipped since financing with a lower rate increases overall buyer affordability! Accordingly, if you are a serious buyer, stay dialed into the market and make sure you have your preapprovals updated and know your mortgage options so that you are ready to strike when rates possibly reach a low point again.

- In Q1 2023, the number of homes listed in Massachusetts was the lowest in recorded history. This stat is not due to a lack of buyers, but rather a lack of sellers as many are hesitating to list their homes. Specifically in March, homes listed were down even more than expected in Massachusetts due to a huge nor’easter that hit the area at the beginning of the month, causing many sellers to delay listing their homes until the weather improved.

- Sellers, list your home NOW for the most money! Right now, the number of active buyers compared to available inventory is unbalanced, tipping in the favor of sellers. Bidding wars are back and intensifying the competition in the market. However, as the year continues, more homes will be listed, but there will be fewer buyers as most will either find a home or explore another option such as resigning their lease. In other words, there will be more supply and less demand.

- Keep in mind, many sellers are also buyers, and one of the reasons they are hesitant to list is because they think they will have nowhere to go once their home sells. But, with so little to choose from currently, buyers are much more willing to accept certain terms upon closing (e.g., subject to your current home selling, a rent back, or an extended closing date), so you will not be homeless if you are in a sell/buy situation.

- Massachusetts home sales are down yet again compared to this time last year. In 2022, we saw an unprecedented housing market, but that level of activity was unsustainable and, accordingly, we are now in a period of over-correction. Therefore, although activity is picking up, overall home sales will most likely still stay lowered compared to 2022 for the next few months.

- Average price increased just slightly in Massachusetts as inventory remains pinched and buyer demand elevated, especially during periods of rate drops. We have been seeing price appreciation slow thus far in 2023, but we may start to see prices tick back up given the level of competition we are currently seeing in the spring market – which will more than likely continue through summer as well.

MASSACHUSETTS

Home Sales Down 22.1%

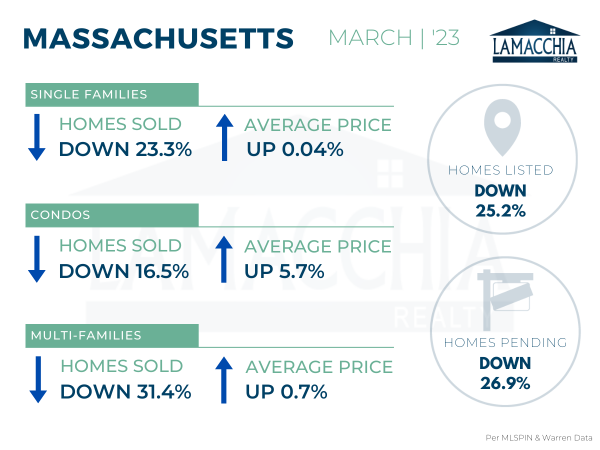

Sales are down 22.1% year over year, with March 2023 at 4,753 compared to 6,105 last March. Sales are down across all categories.

- Single families: 3,591 (2022) | 2,756 (2023)

- Condominiums: 1,826 (2022) | 1,525 (2023)

- Multi-families: 688 (2022) | 472 (2023)

Average prices have continued their rise with another year-over-year increase of 1.1%, now at $599,641. Prices increased in every category.

- Single families: $656,844 (2022) | $657,107 (2023)

- Condominiums: $461,604 (2022) | $488,129 (2023)

- Multi-families: $646,809 (2022) | $651,464 (2023)

Homes Listed For Sale:

The number of homes listed is down by 25.2% when compared to March 2022, as would-be sellers are concerned about jumping into the market.

- 2023: 6,817

- 2022: 9,118

- 2021: 9,549

Pending Home Sales:

The number of homes placed under contract is down by 26.9% when compared to March 2022.

- 2023: 5,724

- 2022: 7,827

- 2021: 9,389

Price Reductions:

The number of price reductions is down 9.8% when compared to March 2022. Sellers, pricing your home right is crucial in this market.

-

- 2023: 361

- 2022: 400

- 2021: 408

Data provided by Warren Group & MLSPIN then compared to the prior year.