March 2023

connecticut housing report

March Highlights

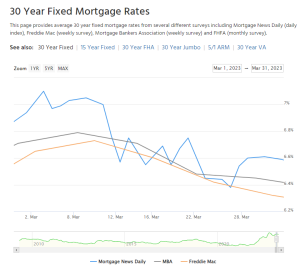

- In March, mortgage interest rates started at

around 7%, but eventually came down from this point throughout the month. Mortgage rates continue to keep consumers and experts busy as economic factors such as inflation as well as monetary policy continue to play a huge role in the story through the spring months. The bank crisis, in particular, affecting major banks like Silicon Valley Bank, caused a shock in the stock market and financial fear and uncertainty rose in consumers. As a result, both buyers and sellers further withdrew themselves from the housing market.

around 7%, but eventually came down from this point throughout the month. Mortgage rates continue to keep consumers and experts busy as economic factors such as inflation as well as monetary policy continue to play a huge role in the story through the spring months. The bank crisis, in particular, affecting major banks like Silicon Valley Bank, caused a shock in the stock market and financial fear and uncertainty rose in consumers. As a result, both buyers and sellers further withdrew themselves from the housing market. - During periods of lowered rates, buyers were quick to obtain financing as lower rates increase their affordability. Therefore, if you are a serious buyer, make sure your preapprovals are updated and you are aware of all your mortgage options – be ready to strike when rates possibly reach a low point again!

- Listings are down in Connecticut compared to March 2022, most likely due to the fact that many sellers are hesitating to list their homes.

- It is important to note that many sellers are also buyers, and their reluctance to list their homes comes from the fear of not having a place to go after selling. However, with supply as low as it is, buyers are more likely to agree to certain terms during the closing process, such as subject to your current home selling, a rent back, or an extended closing date. Thus, if you are in a sell/buy situation, there are options, and you will not end up homeless!

- Sellers, you should be listing your home NOW to get the most money! Currently, buyers are facing a lack of inventory, even more so in Connecticut where year-over-year inventory is at its lowest level since 2017! Low supply coupled with high buyer demand has dialed up competition and increased the number of bidding wars in the market. However, as the year progresses, more homes are expected to hit the market, while the number of buyers is anticipated to decrease as many will have found a home or chosen another alternative, such as renewing their lease.

- Home sales are down in Connecticut compared to this time last year. In 2022, the real estate market experienced unprecedented levels of activity, but ultimately these levels were unsustainable, so we are now in a period of over-correction. Therefore, even though the market is heating up, overall home sales are still likely to remain lower than in 2022 in the months to come.

- The average price in Connecticut only experienced a slight increase in March 2023. Limited inventory and heightened buyer demand, particularly during periods of rate drops, have slowed price appreciation so far in 2023, but given the current level of competition in the spring market, which is expected to continue through summer, prices could start to push upwards again.

CONNECTICUT

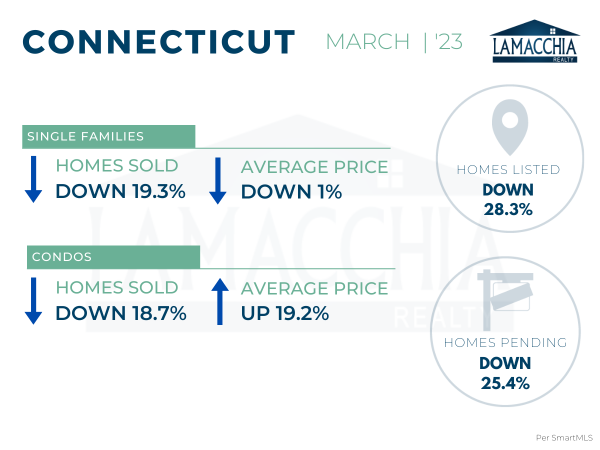

Home Sales Down 19.1%

Sales are down 19.1% year over year, with March 2023 at 2,665 compared to 3,296 last March. Sales are down across all categories.

- Single families: 2,473 (2022) | 1,996 (2023)

- Condominiums: 823 (2022) | 669 (2023)

Average prices have increased by 1.9% compared to last year, now at $456,307 from $447,626. Specifically, single-family prices decreased by 1.0%, but condo prices increased by 19.2%.

- Single families: $508,618 (2022) | $503,603 (2023)

- Condominiums: $264,427 (2022) | $315,196 (2023)

Homes Listed For Sale:

The number of homes listed is down by 28.3% when compared to March 2022 as would-be sellers are concerned about jumping into the market.

- 2023: 3,448

- 2022: 4,806

- 2021: 5,856

Pending Home Sales:

The number of homes placed under contract is down by 25.4% when compared to March 2022.

- 2023: 2,888

- 2022: 3,872

- 2021: 4,376

Data provided by SmartMLS then compared to the prior year.