February 2023

new hampshire housing report

February Highlights

- The New Hampshire housing market has shown some signs of momentum, but overall February home sales remain considerably lower than last year. The market typically experiences lower activity during the beginning of the year, but we should see increasing levels of activity as we continue into the spring and early summer months. Note, nationally, existing home sales have risen by 14.5% in February compared to last year, with a 4.0% increase in the Northeast specifically.

- Economic factors, such as rising inflation and increased mortgage rates, are significantly impacting consumer sentiment and spending. However, mortgage rates have fallen from their recent highs and are expected to continue doing so in the coming weeks. Important to remember that bad news for the economy usually translates to good news for the housing market and mortgage rates. Anthony explains this further in his recent video.

- Declining mortgage rates should be good news to homebuyers as this increases your overall affordability. Staying informed of your mortgage options and prepared with updated preapprovals will make you ready to strike and WIN in this market!

- Many sellers are hesitating to list their homes to keep their low, pandemic mortgage rate, but we are starting to see an increase in homes listed meaning more options and therefore less competition in the market.

- Sellers, right now is the best time to get your home on the market to sell it for more than you would in a few months. Inventory is low and there are serious buyers looking to purchase, but as more inventory inevitably becomes available as we head further into the year, buyers will have more options to choose from and your advantage is lost.

- Pricing your home accurately for your area will be critical to selling your home quickly and for the most money – don’t overplay your hand! If your home is sitting on the market, the first thing to evaluate is price!

- Important to note that, as predicted, there was an increase in multiple offer situations in February given there are more buyers than sellers in the market. This will surely decrease as inventory starts to rise and the overall sense of urgency lessens as a result.

- Average price increased slightly in NH, but there is still not enough inventory to drive prices dramatically down. Also, this slight increase shows the demand in the market (i.e., buyers), a number that will surely go up with mortgage rate drops. As the levels continue to increase, price appreciation will continue to slow and may even reverse.

- As the market is ever-evolving, working with an experienced and knowledgeable REALTOR® will be crucial to finding success!

NEW HAMPSHIRE

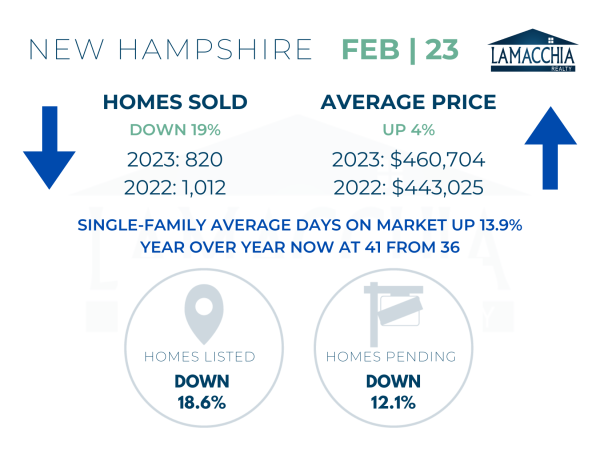

Sales are down 19% year over year with February 2023 at 820 compared to 1,012 last February. Sales are down across all categories.

- Single families: 686 (2022) | 564 (2023)

- Condominiums: 241 (2022) | 201 (2023)

- Multi-families: 85 (2022) | 55 (2023)

Average prices have continued their rise with another year-over-year increase of 4%, now at $460,704. Prices increased in every category.

- Single families: $484,553 (2022) | $492,776 (2023)

- Condominiums: $336,110 (2022) | $371,702 (2023)

- Multi-families: $411,008 (2022) | $457,086 (2023)

Homes Listed For Sale:

The number of homes listed is down by 18.6% when compared to February 2022 as would-be sellers are concerned about jumping into the market with all the rising rate headlines.

- 2023: 1,000

- 2022: 1,228

- 2021: 1,383

Pending Home Sales:

The number of homes placed under contract is down by 12.1% when compared to February 2022.

- 2023: 1,072

- 2022: 1,219

- 2021: 1,498