The Lamacchia Realty South Florida Housing Report presents overall home sale statistics and highlights the average sale prices for single families, condominiums/townhomes in Broward County, Miami-Dade County, and Palm Beach County for November 2022 compared to November 2021. It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market.

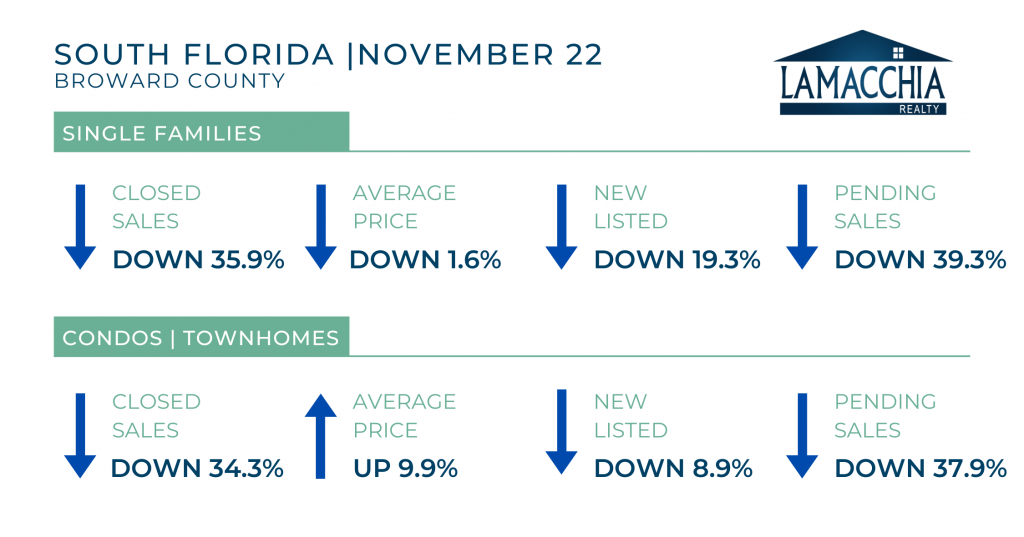

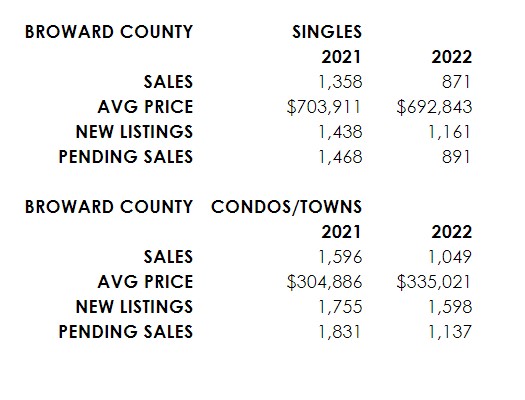

Broward County

In November of 2022, Broward County single-family and condo/townhome closed sales, new listings, and pending sales decreased. The average price increased for condos and townhomes but decreased slightly for single-family homes.

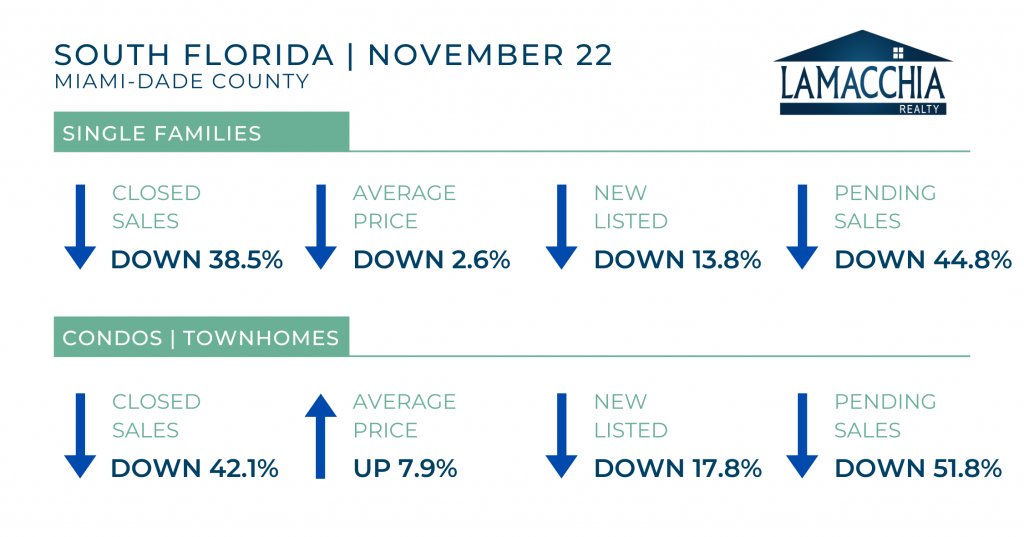

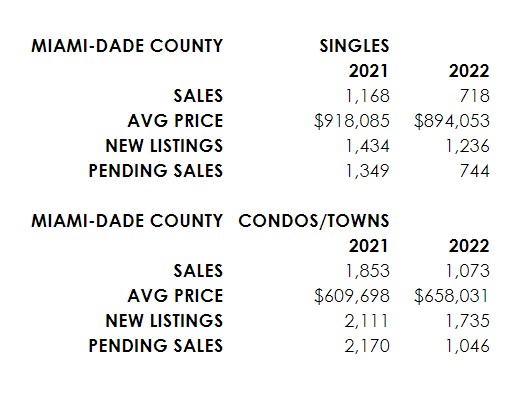

Miami-Dade County

In November of 2022, Miami-Dade single families and condos/townhomes saw decreases in closed sales, new listings, and pending sales, with increases in average price for condos and townhomes, and decreases in average price for single family homes.

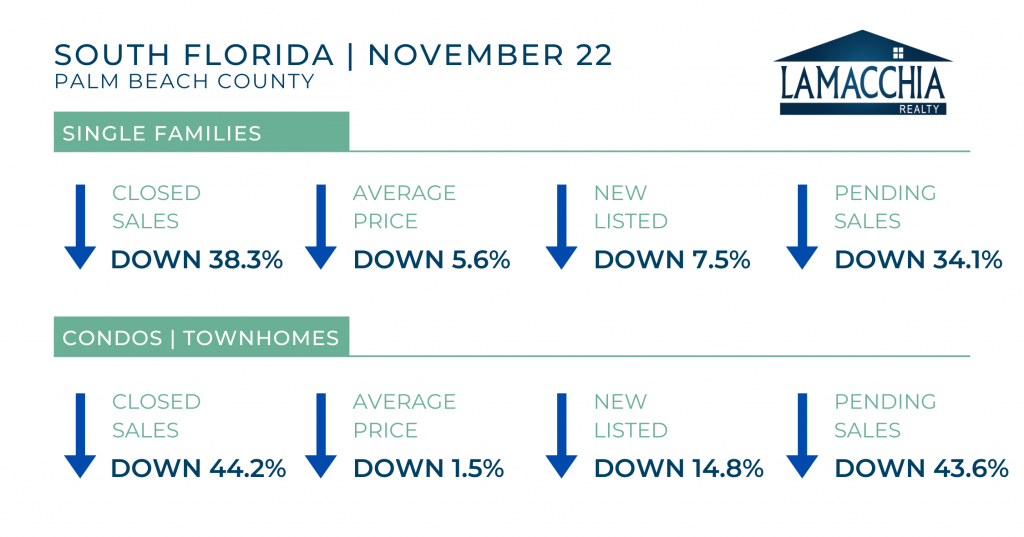

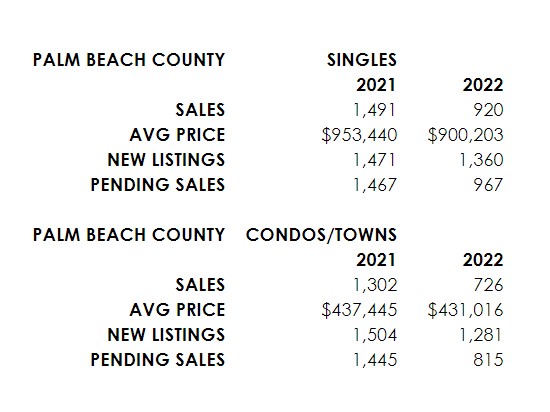

Palm Beach County

In November of 2022, Palm Beach County single families and condos/townhomes saw a decrease in all categories.

Highlights

- Sales, average prices, new listings, and pending sales are generally down in South Florida in November, with the exception of average prices for condos in Miami-Dade and Broward counties.

- Real estate reporting is delayed, so the closings that happen in November are largely from listings that happened at the end of summer, right when the rate hike really impacted buyer affordability and slowed down activity.

- Rates have remained recently in the 6s and with prices staying relatively flat (only down by a small percentage) buyers did get a break over the past four weeks.

- The market adjustment that is being experienced nationally is hitting the South Florida market harder. The affordability for homes in this area has been hit extra hard with the prices rising as much as they did over the past year combined with the insurance premiums rising due to the climate crisis and large companies pulling out of the state. Other contributing factors include the tightening or removal of work-from-home policies in many industries, increased condo fees & regulations as well as an overabundance of Airbnbs available in the area.

- Two new insurance reform bills were just recently passed to hopefully provide some relief to homeowners as well as to provide incentives to carriers in the hopes to stabilize the property insurance market.

- Sellers, remember that homes do still sell over the holidays– the volume of buyers may be diminished, but the ones that are out there are the truly motivated ones on the search.

- Buyers should be feeling relieved that rates are in the 6s, and those that are motivated to buy should also remember that there are several mortgage options such as buydowns and adjustable rate mortgages that can help keep rates and therefore, monthly payments lower for the first years of the loan.

*Data provided by Florida Realtors® SunStats