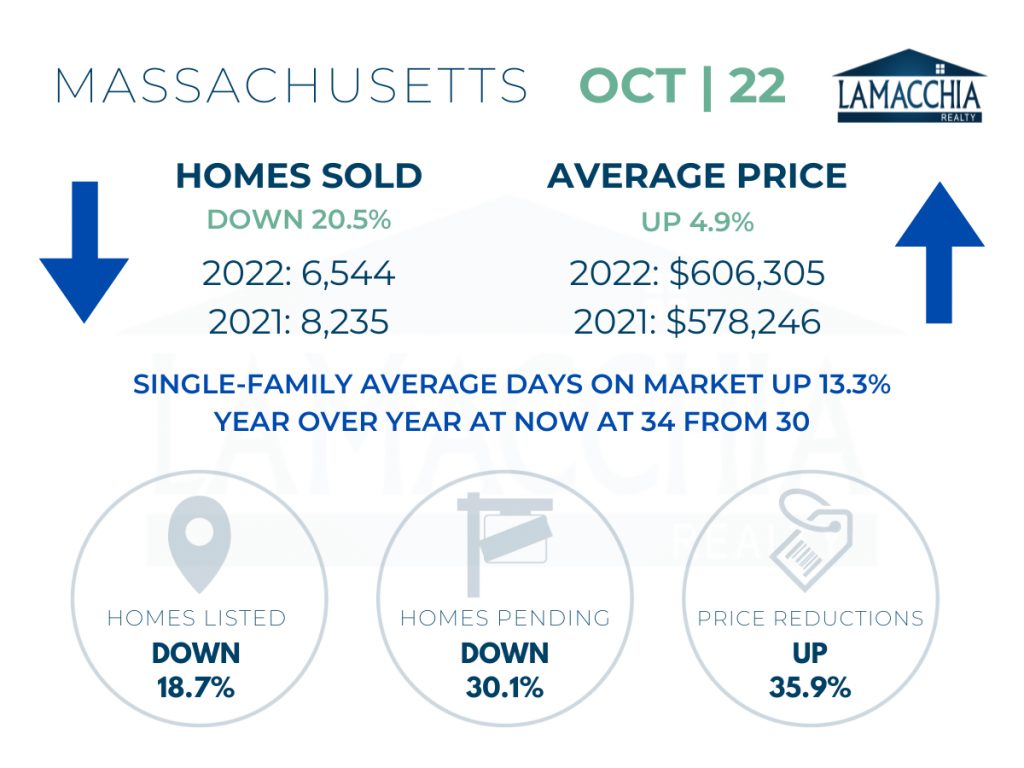

Massachusetts Home Sales Down 20.5%

Sales are down 20.5% year over year with October 2022 at 6,544 over 8,235 last October. Sales are down across all categories.

- Single families: 5,285 (2021) | 4,183 (2022)

- Condominiums: 2,089 (2021) | 1,729 (2022)

- Multi-families: 861 (2021) | 632 (2022)

Average prices have continued their rise with another year-over-year increase of 4.9%, now at $606,305. Prices increased in every category.

- Single families: $639,453 (2021) | $668,535 (2022)

- Condominiums: $438,632 (2021) | $503,663 (2022)

- Multi-families: $657,618 (2021) | $627,018 (2022)

Homes Listed For Sale:

The number of homes listed is down by 18.7% when compared to October 2021 as would-be sellers are concerned about jumping into the market with all the rising rate headlines.

- 2022: 6,610

- 2021: 8,135

- 2020: 10,249

Pending Home Sales:

Price Reductions:

Sellers who haven’t attracted much interest to their listing in 30 days are urged to consider adjusting their price. The number of price reductions is up 35.9% when compared to October 2021.

-

- 2022: 784

- 2021: 577

- 2020: 962

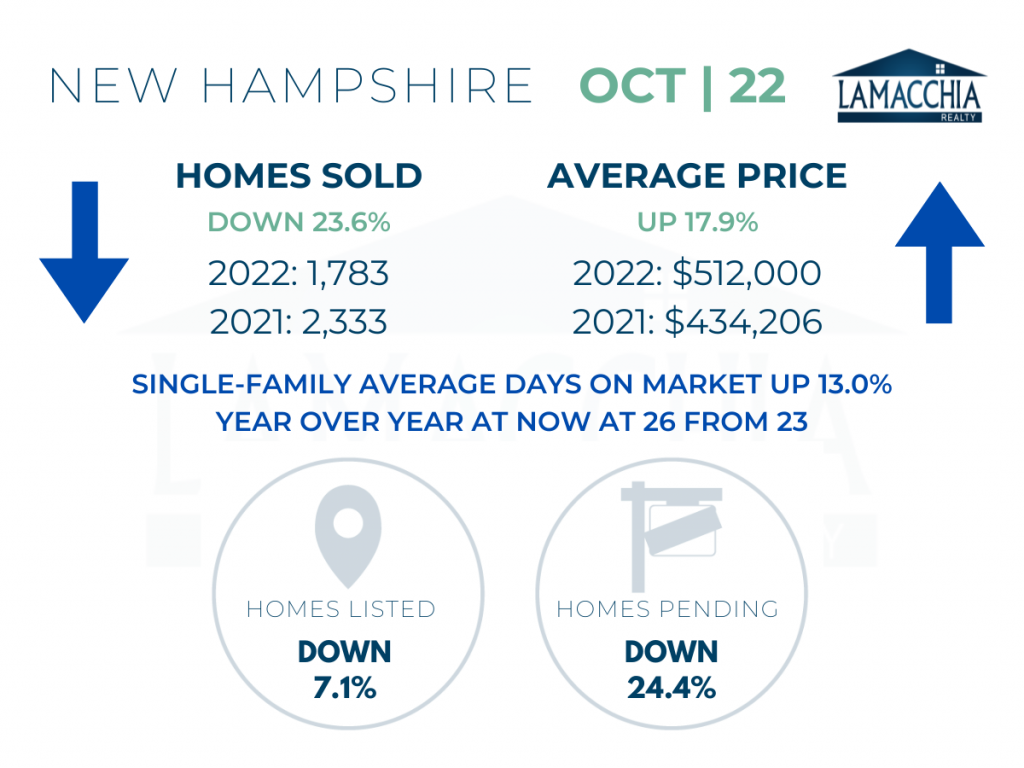

New Hampshire Home Sales Down 23.6%

Single-family, condo home sales, and multi-family home sales have all decreased overall by 23.6% when compared to October 2021.

- Single families: 1,736 (2021) | 1,295 (2022)

- Condominiums: 473 (2021) | 378 (2022)

- Multi-families: 124 (2021) | 110 (2022)

Prices overall have continued to increase, now up 17.9% to $512,000 compared to October 2021. Prices increased in every category.

- Single families: $454,525 (2021) | $546,365 (2022)

- Condominiums: $351,095 (2021) | $412,878 (2022)

- Multi-families: $466,758 (2021) | $448,035 (2022)

Homes Listed For Sale:

The number of homes listed is down by 7.1% when compared to October 2021.

- 2022: 1,784

- 2021: 1,920

- 2020: 2,569

Pending Home Sales:

The number of homes placed under contract is down by 24.4% when compared to October 2021.

- 2022: 1,726

- 2021: 2,283

- 2020: 2,693

Price Reductions:

Sellers who haven’t attracted much interest to their listing in 30 days are urged to consider adjusting their price. The number of price reductions is up 35.9% when compared to October 2021.

-

- 2022: 784

- 2021: 577

- 2020: 962

Highlights:

- Potential sellers who are locked into low mortgage rates are hesitant to list because they don’t want to lose their low mortgage rate when they apply for a new mortgage for their future purchase.

- Buyers are hesitating to make an offer or even stay in the market as affordability is diminished with the higher rates and still rising home prices.

- Sellers should know there is a way to leverage your low rate by listing your home and allowing the buyer to assume your low mortgage rate.

- Buyers will pay more for the home if they can also assume your low rate to save money on their monthly payments.

- Buyers, you should know that you can qualify for a mortgage and assume a seller’s low rate, which could get you into a 2-4% mortgage!

- There are other mortgage options, such as a Buydown or even ARMs that will get you into a home at a lower than current rate.

- Homes do sell during the holidays- those who are in the market are generally very motivated to get deals done before the new year.

- Pending home sales down indicates that sales will be down next month.

- Prices, and therefore values, are still rising.