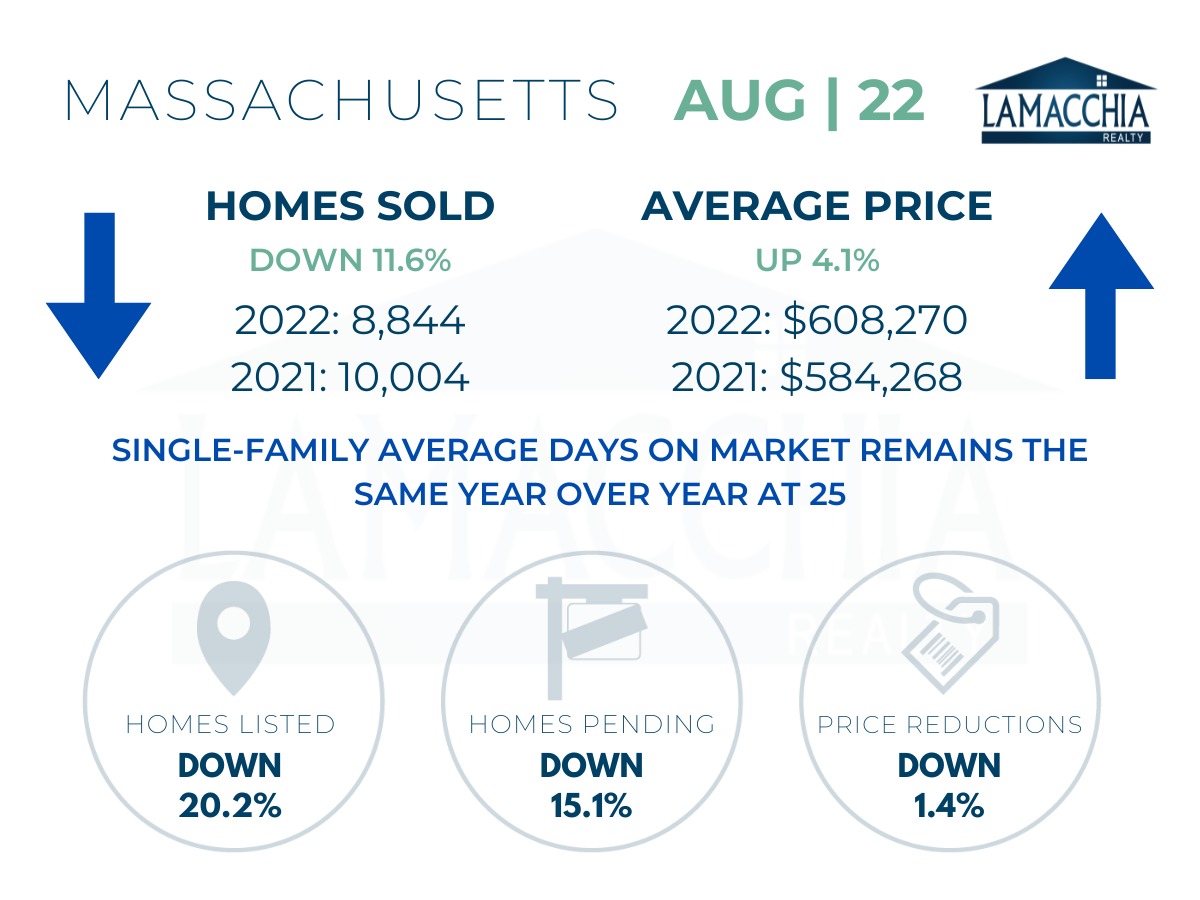

Massachusetts Home Sales Down 11.6%

Massachusetts Home Sales Down 11.6%

Sales are down 11.6% year over year with August 2022 at 8,844 over 10,004 last August. Sales are down across all categories.

- Single families: 6,318 (2021) | 5,732 (2022)

- Condominiums: 2,773 (2021) | 2,298 (2022)

- Multi-families: 913 (2021) | 814 (2022)

Average prices have continued their rise with another year-over-year increase of 4.1%, now at $608,270. Prices increased in every category.

- Single families: $665,256 (2021) | $679,598 (2022)

- Condominiums: $441,472 (2021) | $470,919 (2022)

- Multi-families: $627,863 (2021) | $658,640 (2022)

Homes Listed For Sale:

Sales have remained down month over month as sellers aren’t as motivated to list as they were during the market boom last summer – evidenced by the fact that the number of homes listed is down by 20.2% when compared to August 2021.

- 2022: 7,100

- 2021: 8,893

- 2020: 9,744

Pending Home Sales:

The number of homes placed under contract is down by 15.1% when compared to August 2021.

- 2022: 7,166

- 2021: 8,418

- 2020: 10,312

Price Reductions:

If you are a seller whose home has been sitting on the market, the price is the first thing to consider adjusting. The number of price reductions is down by 1.4% when compared to August 2021.

-

- 2022: 701

- 2021: 711

- 2020: 727

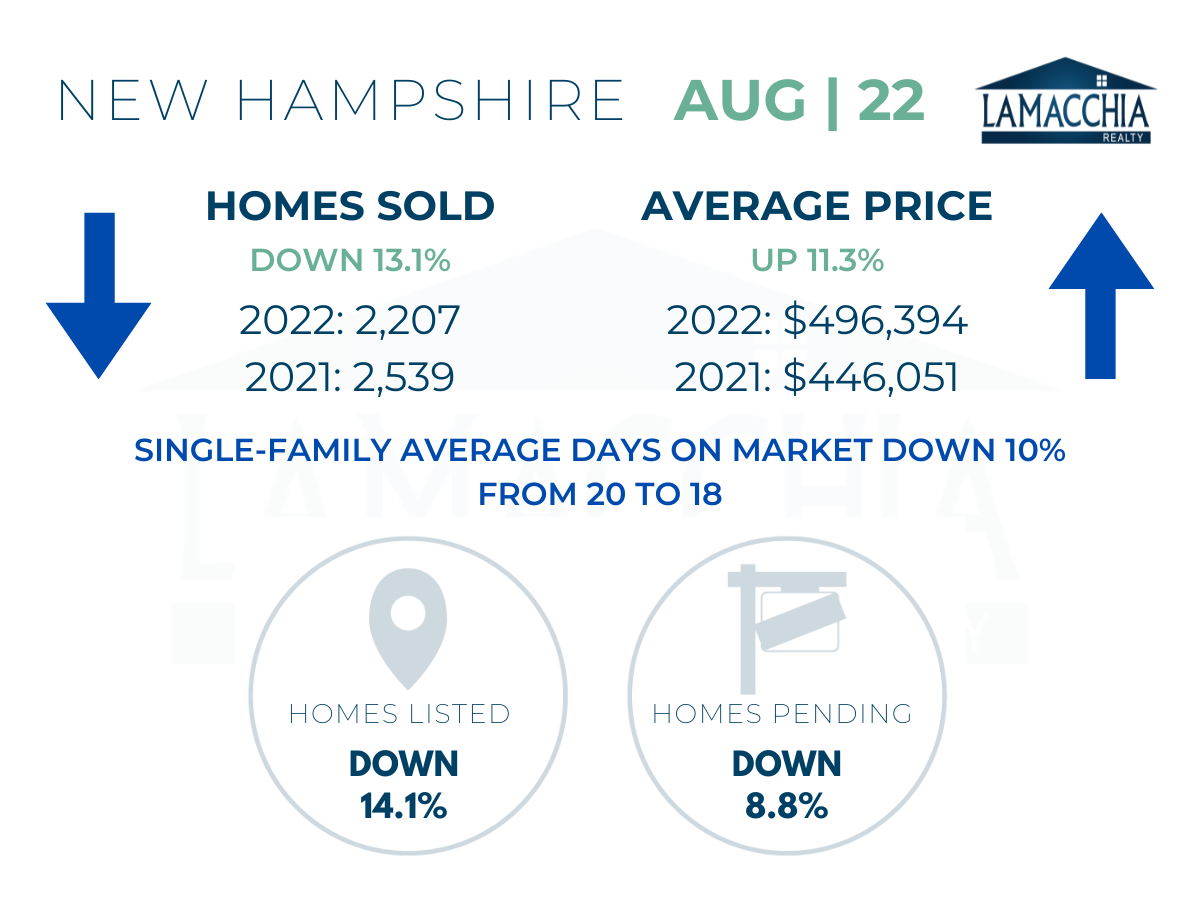

New Hampshire Home Sales Down 13.1%

New Hampshire Home Sales Down 13.1%

Single family, condo home sales and multi-family home sales have all decreased when compared to August 2021.

- Single families: 1,881 (2021) | 1,659 (2022)

- Condominiums: 497 (2021) | 461 (2022)

- Multi-families: 161 (2021) | 87 (2022)

Prices overall have continued to increase, now up 11.3% to $496,394 compared to August 2021. Prices increased in every category.

- Single families: $476,987 (2021) | $527,286 (2022)

- Condominiums: $332,529 (2021) | $395,451 (2022)

- Multi-families: $435,051 (2021) | $442,193 (2022)

Homes Listed for Sale:

The number of homes listed is down by 14.1% when compared to August 2021.

- 2022: 2,272

- 2021: 2,645

- 2020: 3,035

Pending Home Sales:

The number of homes placed under contract is down by 8.8% when compared to August 2021.

- 2022: 2,369

- 2021: 2,597

- 2020: 3,011

Highlights

- With summer coming to an end, buyers and sellers alike should be prepared for not only the change in season, but for the change in the market as well. Luckily, Fall is the best time to buy or sell your home, so don’t hesitate and miss out on the opportunity this season brings! Anthony spoke about what to expect from the market this Fall on Boston 25 news with Gene Lavanchy.

- Buyers, due to seasonality and supply & demand, you will most likely secure a home for a lower sale price than you would have in months past.

- Heightened interest rates continue to keep many potential buyers out of the market, meaning demand is lowered, and homes are no longer flying off the market as soon as they are listed, contributing to increasing levels of available inventory. This lessening in competition gives active buyers more choice, time, and a break from the market of the beginning of the year which was saturated with bidding wars, paying over asking and waiving contingencies.

- For buyers that are hesitating, remember, you can refinance your way out of a higher rate, but you cannot reverse your way out of paying substantially over asking price for a home during times of tighter competition.

- There are also several benefits to homeownership, one of them being not having to pay rent (i.e., someone else’s mortgage). The rental market has become frenzied in the last few months with interest rates increasing since many potential buyers came out of the market and decided to rent/keep renting. As such, the increase in demand for a limited supply of rentals has pushed the cost of rents significantly upwards.

- Sellers, the most important thing to consider when listing your home this Fall is the price and making sure that you are not overpricing your home to ensure you can remain competitive in the market. Remain realistic and reasonable and remember this market has changed since the beginning of the year. If you price too high, you could potentially be making less in the end.

- In August, the number of closed sales was still down, but not nearly as much as they were in July when closed sales numbers were down substantially due to the initial rate spike in late May which suddenly slowed the market down and impacted buyer affordability. Rates leveled out and even came down mid-summer, allowing sales numbers to come back up slightly. Now, rates are starting to climb once again, so we may see a drop in closed sales again in early Fall.

- Even though there is a lessening of demand, this does not translate to cheaper housing. Inventory levels, although rising, are still too low to drive prices down (i.e., supply is too low). However, the rate in which home prices have been increasing will slow as more inventory gets added to the market, a trend we are already seeing evidence of and is expected to continue as the year rolls on.

Data provided by Warren Group & MLSPIN for MA, and by NEREN for NH then compared to the prior year.