This Lamacchia Mid-Year Housing Report presents overall home sale statistics as of the first six months of 2022 compared to the same period last year, January 1st to June 30th, 2021. Highlighted in this report are the average sale prices for single-family and condo/townhomes in South Florida (Miami – Fort Lauderdale – West Palm Beach MSA) along with the number of homes listed for sale and newly pending.

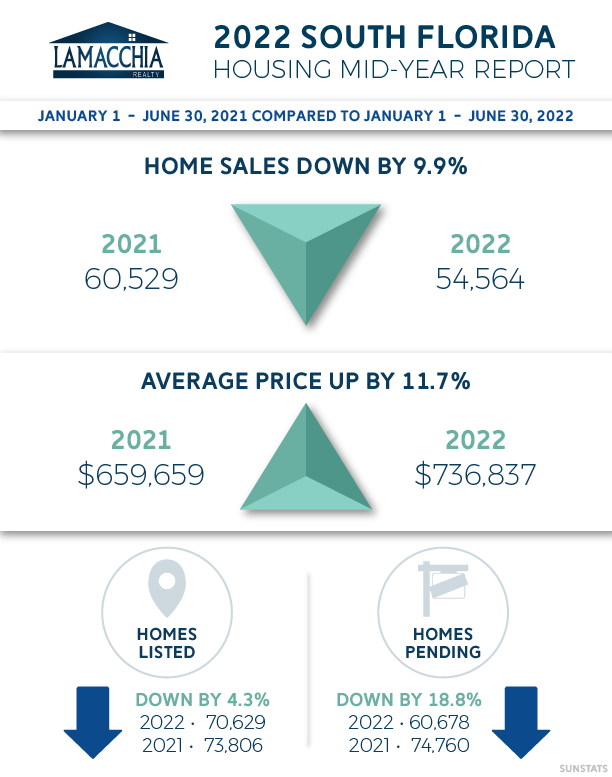

Sales Decrease by 9.9%

Home sales decreased overall by 9.9% for Miami – Fort Lauderdale – West Palm Beach MSA- moving from 60,529 to 54,564 in the first half of 2022, down by 5,965 sales.

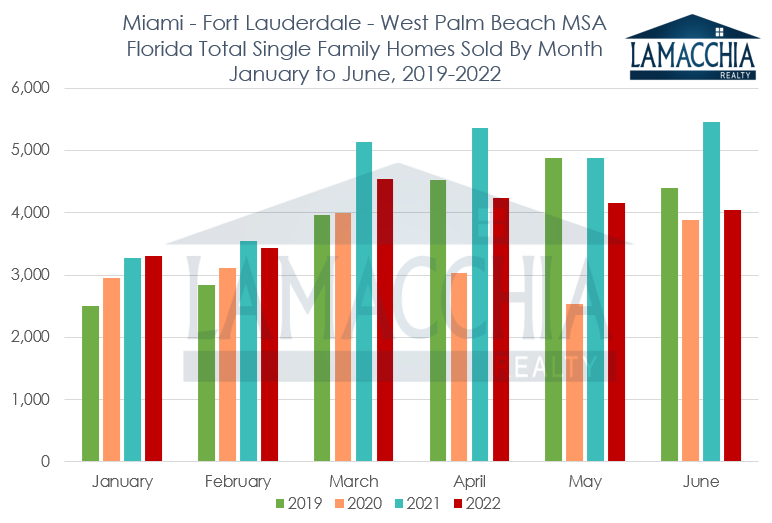

- Sales decreased for single families by 14.2% now at 23,734 compared to 27,667 last year this time.

- The increases we saw last year were a result of the market playing catch up in the post-pandemic market.

- Major changes with mortgages, including the recent rate spike as well as with the rules for second homes, have impacted demand.

- In the chart below, you can see that with the exception of January, single family sales in 2022 were down every month in the first half of this year over last. This is likely because single family sales last year were through the roof due to the mad rush for buyers to secure their own space after the pandemic.

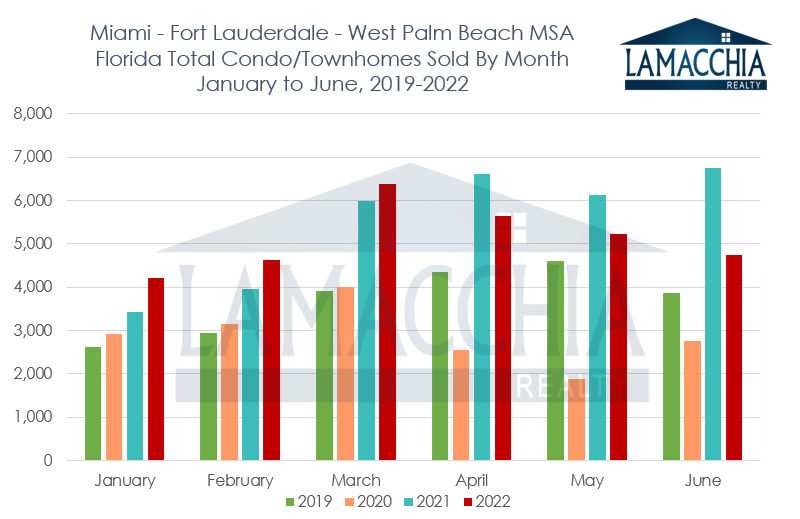

- Condo/townhome sales decreased by 6.2% coming in at 30,830 over 32,862 in 2021.

- The chart below shows how condo/townhomes outperformed 2021 in the winter months, but spring halted sales when rates increased, and sales then fell beneath 2021 levels.

- Condo regulations becoming much more stringent due to the tragedy in Surfside also contributed to the decline in sales.

Prices Up 11.7% in South Florida

Average sale prices in South Florida increased by $77,178 overall, now at $736,837 over $659,659 from 2021 for Miami – Fort Lauderdale – West Palm Beach MSA.

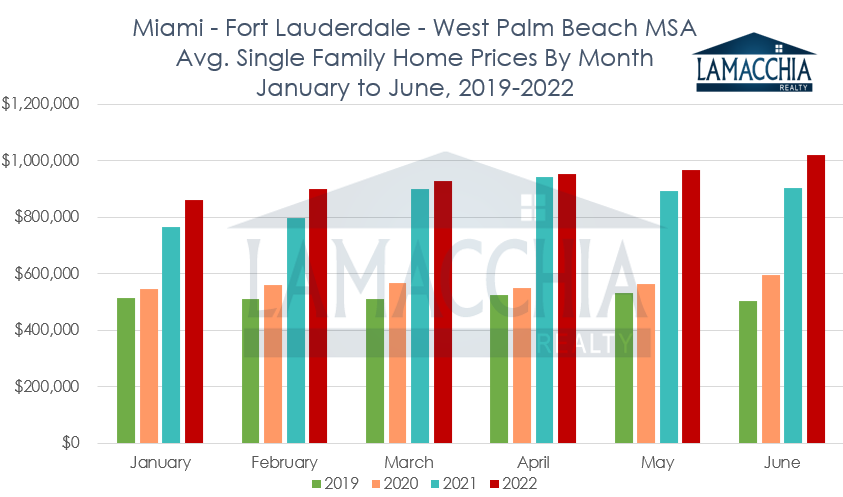

- Single family prices are up by 8.2% now at $938,289 from $867,051.

- Despite mortgage rate increases, the prevalence of cash buyers as well as lingering competition have helped keep prices rising. They will not continue to rise at the rate we’ve been seeing, but they certainly show no signs of decreasing.

- In the chart below, you can see that prices have been up over 2021 every month in the first half of 2022, furthermore they’ve increased year over year in all the years depicted.

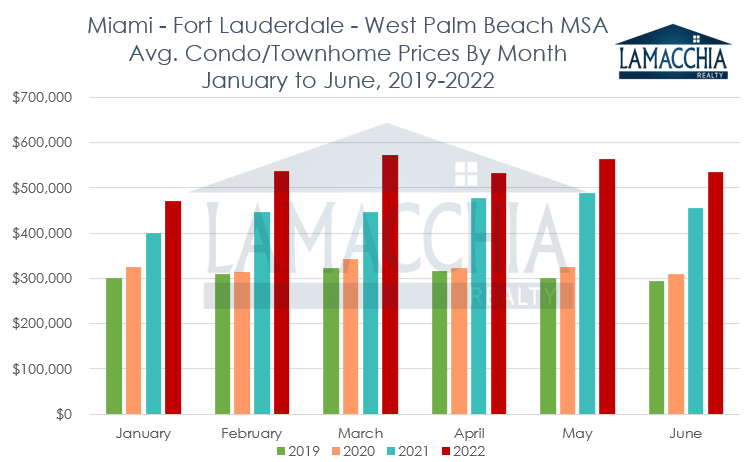

- Condo/townhome prices increased by 18.4% year over year, now reaching $535,584.

- The rate of increase is slowing down but we are still seeing strong gains in the first half of the year as a portion of these sales were due to accepted offers before the giant increase in mortgage rates.

- You can see in the chart below how prices haven’t decreased year over year in four years.

Homes Listed for Sale:

Listings overall decreased by 4.3% in the first half of 2022 over the first half of 2021 now at 70,629 from 73,806. New single-family listings are down by 3.8% and are down by 4.7% for condos/townhomes.

- Sellers are hesitating to list lately, as they’d be selling their property that has a locked mortgage rate that could potentially be half of what they’d be getting themselves into by purchasing now.

- A market adjustment does tend to cause pause for buyers and sellers, but real estate is essentially a need-based market. People will always continue to buy and sell as life changes will still dictate the need to relocate, trade up, or downsize.

- With listings down, we are likely to see pending sales down as new listings indicate future accepted offers.

Pending Sales:

Pending home sales in South Florida decreased by 18.8% over this timeframe in 2021. There were 60,678 pending sales in 2022 compared to 74,760 in 2021. Single family pending sales decreased by 20.3% now at 26,502 and condo/townhome pending sales decreased by 17.7%

- Rising mortgage rates diminished buyer affordability over the past few months, giving buyers a sense of sticker shock not seen with the previously historically low rates.

- Those buyers who needed mortgages may have made offers when rates were much lower and by the time the offer was accepted, may not have qualified for that purchase price with the higher rates, thereby making the purchase impossible and lowering the rate of pending sales.

- Lower pending sales is actually good news for buyers as that indicates the frenzied market is calming down giving them signs of more selection.

- Last year’s numbers were artificially inflated due to the post-pandemic market. Many buyers with pent up motivation were unleashed on the market last year after the borders were reopened for international buyers, and others who were able to continue working remotely, only naturally making last year’s numbers spike and making this year look lower comparatively. It’s still a very strong market.

Inventory

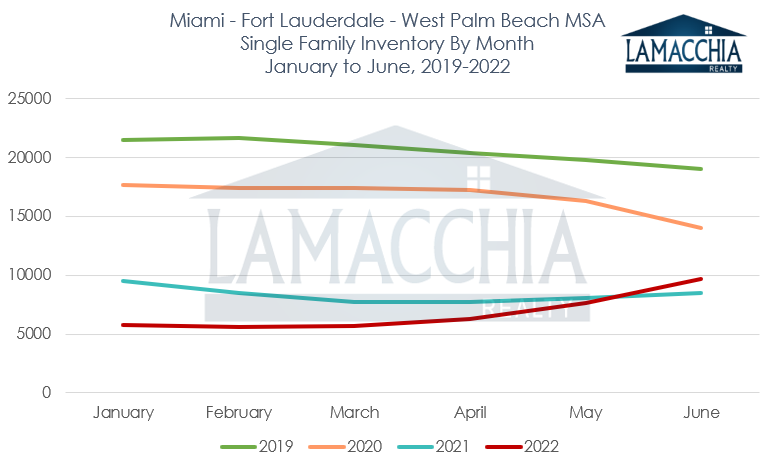

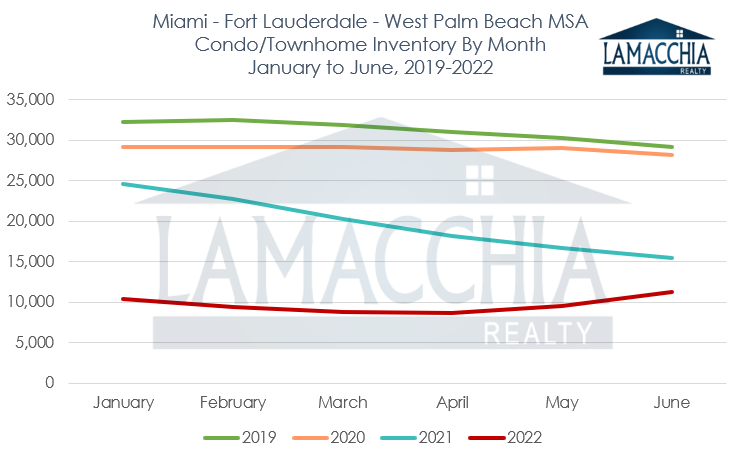

The charts below for both single families and for condo/townhomes each tell a similar story. The first half of every year back to 2019 had lower inventory that the prior year, and May of 2022 is the first time we can see a significant turn in the upward direction. Single families exceeded inventory year over year compared to 2021, where condo/townhomes aren’t quite there yet but the trend is trajected in that direction.

Inventory is what is left after pending sales consume what’s listed; it’s the supply that remains after demand takes what it wants. 2019 was the year not yet impacted by the pandemic with inventory at the highest level in the charts below, and every year after that you can see that demand was so high that inventory couldn’t keep up. This was referred to as a frenzied market and that upward trend in May of 2022 is the first sign that the frenzy is cooling off.

Supply is increasing as buyers are pulling out of the market due to factors such as rising rates, or due to having to return to the office once again and not being able to work wherever they want. As well, rates for second homes became much higher for buyers which made it more costly to obtain that vacation home and therefore no longer an option for some.

Predictions for the Rest of the Year:

South Florida is experiencing what the rest of the country overall is; the frenzy is ending. Prices are still increasing but that has slowed down and it will slow down much more. Sales are still very high, but when you compare the first half of 2022 to the first half of 2021 when sales, average prices, listings and pending sales were all significantly higher, it’s only natural to think the market is slower than it really is. The artificial inflation of the 2021 market and the more normal behavior of 2022 are a tough comparison.

The market had to eventually become more grounded after two years of supply being eviscerated by never-before-seen demand. The mortgage rate spike as well as the new rules for second home mortgages were significant factors in diminished buyer activity over the past few months in South Florida. Whispers of a crash, however incorrect they may be, impact consumer sentiment which is unfortunate as the cost of waiting is very real. Prices are still increasing, and rates are predicted to stay up in the 5’s or 6’s for the foreseeable future, if not continually climb. The monthly payment for a home will therefore be lower now than it would be in three months without anything but time impacting the value of the property.

A market adjusting is the anecdote to a potential crash, had the market continued into the stratosphere like it was, a crash down the line may very well have been the only way out. Being that the adjustment is happening now, consumers must get used to the new normal. Buyers need to have their preapprovals up to date so they know what they can afford – and should keep in mind that there are more financing options beyond a 30-year fixed for primary homes. Sellers, who have had the upper hand for years now, need to be reasonable with their list price so that their target buyers can afford to purchase the home and to draw enough attention to potentially see a multiple offer situation.

Data provided by SunStats then compared to the prior year.