March 2023

new hampshire housing report

March Highlights

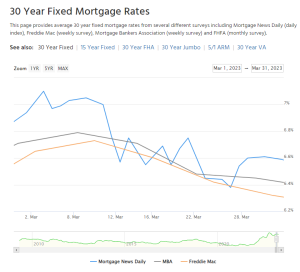

- Mortgage interest rates started at around 7% in

March, but lowered as the month went on. Economic factors such as inflation as well as monetary policy will continue to impact mortgage rates as spring rolls on – keeping consumers and experts alike on the edge of their seats. Specifically, the current bank crisis, affecting significant financial institutions such as Silicon Valley Bank, sent shockwaves through the stock market, leading to financial fear and uncertainty among consumers. Consequently, both buyers and sellers were deterred from entering the market due to these events.

March, but lowered as the month went on. Economic factors such as inflation as well as monetary policy will continue to impact mortgage rates as spring rolls on – keeping consumers and experts alike on the edge of their seats. Specifically, the current bank crisis, affecting significant financial institutions such as Silicon Valley Bank, sent shockwaves through the stock market, leading to financial fear and uncertainty among consumers. Consequently, both buyers and sellers were deterred from entering the market due to these events. - With these ebbs and flows, serious buyers need to stay tuned into the market so that they are ready to strike if rates drop down. Financing with a lower rate increases overall buyer affordability, so make sure you have updated preapprovals and have reviewed all your mortgage options.

- Listings in New Hampshire are down significantly year over year as many sellers are hesitating to list their homes. Additionally, a massive nor’easter hit New Hampshire at the beginning of the month, so homes listed were even lower than expected as many sellers postponed listing their homes until the inclement weather cleared.

- However, listing your home NOW could get you the most money! Lack of inventory coupled with high buyer demand has intensified the level of competition in the market, exemplified by the return of bidding wars. As such, sellers currently have the advantage but this won’t last long. More and more sellers will list their homes in the next few months which increases supply. At the same time, buyer demand will waiver as many will have already secured a home or made the decision to continue renting for another year.

- Remember that a significant number of sellers are also buyers, and their reluctance to put their homes on the market stems from the belief that they will have nowhere to go once the sale is complete. However, with such limited inventory, buyers are more likely to agree to certain terms during the closing process (such as subject to the sale of your current home, a rent back, or an extended closing period), which means you will not be without a place to live if you’re buying and selling at the same time.

- Home sales in New Hampshire have once again decreased when compared to last year. The housing market experienced unparalleled activity in 2022, but this level of activity was not sustainable which is why we are now experiencing an over-correction in the market. As such, despite a recent uptick in activity, home sales will likely remain lower than 2022 levels for the next several months.

- Average sales price in New Hampshire increased only slightly when compared to March 2022. Limited inventory and high buyer demand (especially during periods when rates are lowered) have helped to slow price appreciation over the last few months, but the current level of competition in the spring market, which is expected to continue throughout the summer, could result in prices creeping back up

NEW HAMPSHIRE

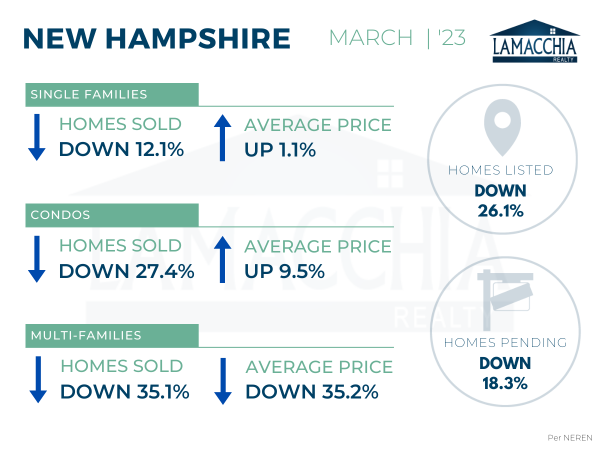

Home Sales Down 18.2%

Sales are down 18.2% year over year, with March 2023 at 1,053 compared to 1,287 last March. Sales are down across all categories.

- Single families: 821 (2022) | 722 (2023)

- Condominiums: 372 (2022) | 270 (2023)

- Multi-families: 94 (2022) | 61 (2023)

Average price increased slightly by 0.6% when compared to last March, now at $498,510. Prices increased for single families and condos but decreased for multi-families.

- Single families: $529,571 (2022) | $535,307 (2023)

- Condominiums: $380,752 (2022) | $416,995 (2023)

- Multi-families: $653,511 (2022) | $423,782 (2023)

Homes Listed For Sale:

The number of homes listed is down by 26.1% when compared to March 2022 as would-be sellers are concerned about jumping into the market.

- 2023: 1,463

- 2022: 1,979

- 2021: 2,266

Pending Home Sales:

The number of homes placed under contract is down by 18.3% when compared to March 2022.

- 2023: 1,347

- 2022: 1,648

- 2021: 2,082

Data provided by NEREN then compared to the prior year.