The Lamacchia Realty South Florida Housing Report presents overall home sale statistics and highlights the average sale prices for single families, condominiums/townhomes in Broward County, Miami-Dade County, and Palm Beach County for September 2022 compared to September 2021. It also looks at other metrics like New Listings and New Pending Sales as they are often the best indicators for predicting future trends in the market.

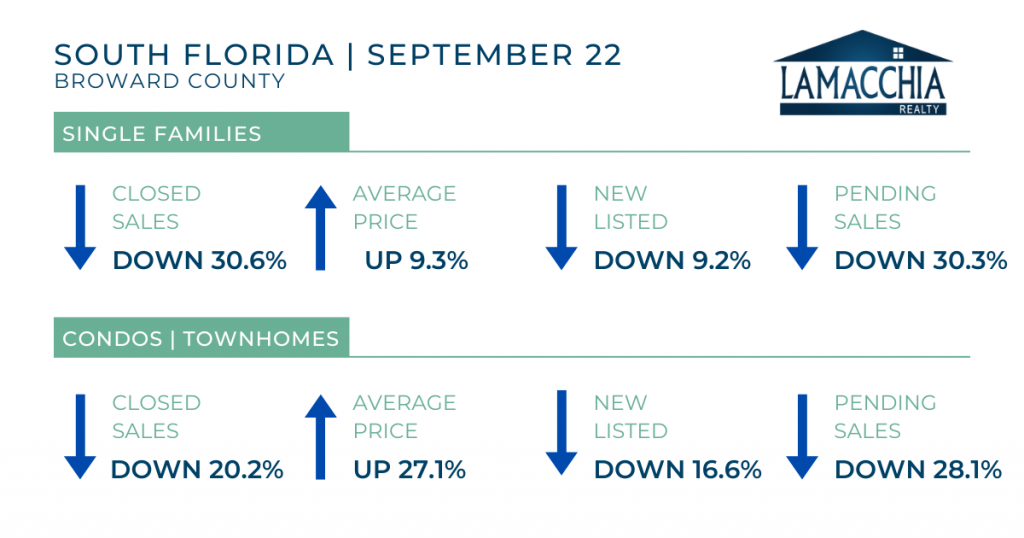

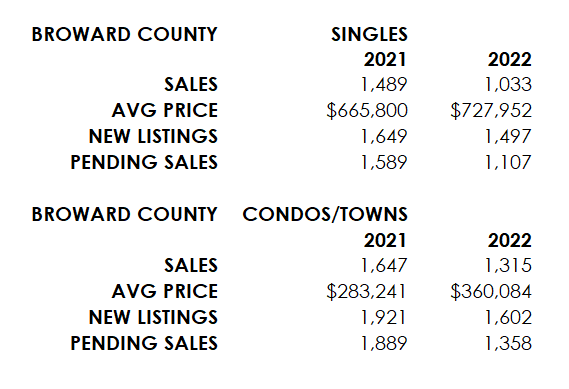

Broward County

Broward County single family and condo/townhome closed sales, new listings, and pending sales decreased. Average price increased in both property types.

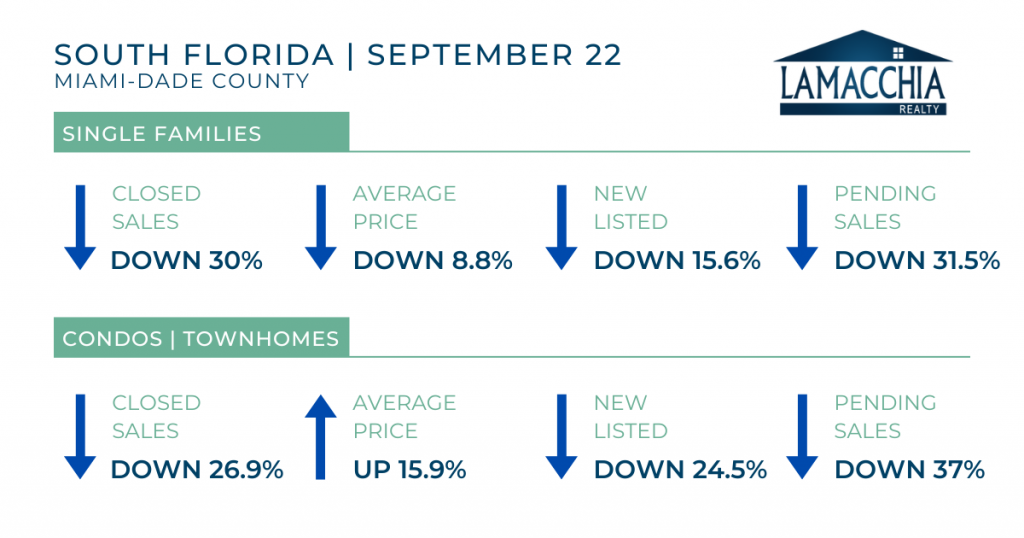

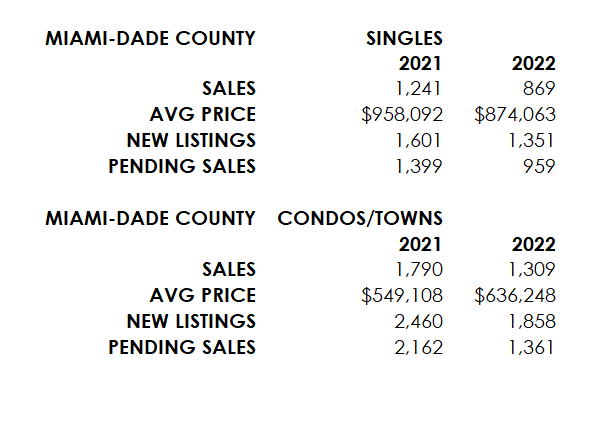

Miami-Dade County

In September of 2022, Miami-Dade single families saw decreases in closed sales, average price, new listings, and pending sales. Miami-Dade condos and townhouses saw decreases in closed sales, new listings and new pending sales, and a slight increase in average sale price. Prices this month for this area are down because luxury sales are down, in fact, there were 10 sales in September of 2021 priced at $10M or higher, and only 3 in September of 2022. Those high priced homes can swing average prices easily, and the average house prices didn’t actually decrease by 9%.

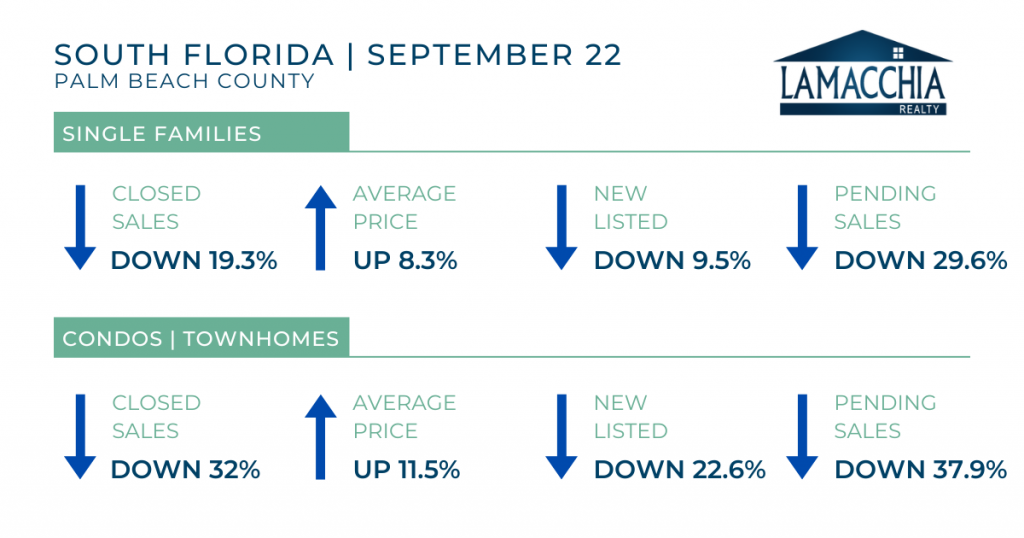

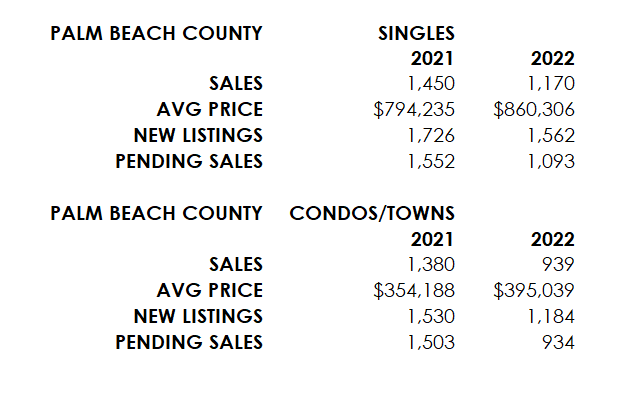

Palm Beach County

Palm Beach County single families and condos/townhomes saw a decrease in closed sales, new listings, and new pending sales and a slight increase in average price.

Highlights

-

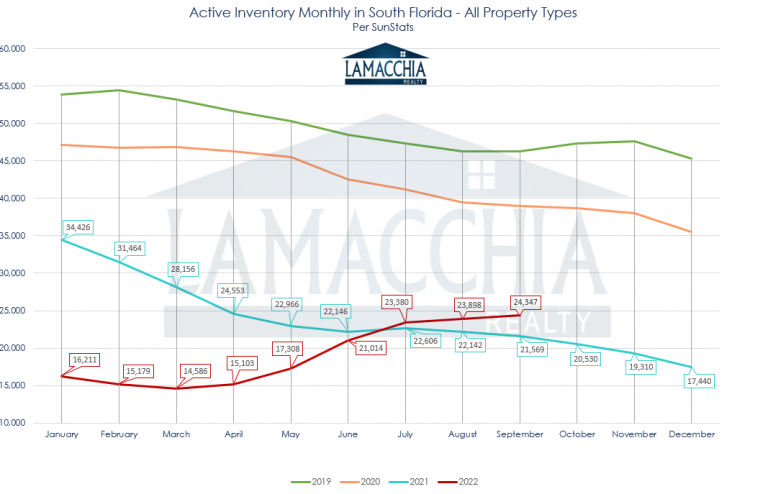

Sales decreased for single families and condos in South Florida when compared year over year, but context is important. 2021 was an outlier year with a frenzied market, and by comparison, would make any strong market seem slow.

-

South Florida’s active inventory levels are still up year over year. The higher mortgage rates are still influencing a lessening of buyer activity as affordability is shrinking with the still rising prices.

-

As inventory levels keep increasing (i.e., more supply), home price appreciation is expected to continue to decelerate. This isn’t to confuse anyone, prices are still higher than they were in September of 2021 but the rate of increase is what is declining. Prices are lower than what they were in the summer when rates were lower, but that is to be expected.

- Consumer sentiment about the rising rates and adjusting market are definitely impacting activity in the market, particularly for sellers who are hesitant to list given they’d be trading in their low rates for the current rates, now in the 7% range.

- The number of homes listed is down again, continuing a three-month trend of diminishing new active listings. This is happening in many other areas of the country where giving up a low rate makes them hesitate to list.

-

The number of closed sales in September was once again down across all counties and categories. Pending sales are also down quite a bit again in September 2022 and this is a big indicator that closed sales will also likely be down again in October.

-

Buyers, Fall is usually the best time to buy and this year is no exception. Diminished buyer affordability means there are fewer buyers in the market, and this lowered demand increases the availability of homes, lessens the extreme competition buyers have been used to seeing in the market, and yields a lessening of bidding wars.

-

Marry the house, date the rate! Purchase the right home now, and if rates drop, refinance! Better to buy and pay your own fixed mortgage than rent and pay someone else’s!

-

Sellers are advised to make informed decisions about their list prices to ensure they’re not overshooting. It would be an easy mistake to overprice a home if it’s based on sales from earlier this year. Using comps to determine a list price is the first step, the next step is to take the current market climate into consideration.

- If a home ends up sitting on the market it may simply be because it’s overpriced and an adjustment is possibly all that needs to be done to get the offers to roll in.

-

Hurricane Ian took a major toll on areas of Florida, and so next month’s reflection of September activity may likely reflect that. More on that as time reveals the outcome.

*Data provided by Florida Realtors® SunStats